What entities need to know about this new federal requirement and how it differs from the District’s beneficial ownership reporting requirement.

Please note that the Federal government’s beneficial ownership information reporting requirements have been affected by a recent federal court order.

Please monitor the Department of Treasury’s beneficial ownership site directly to keep apprised of changes to the requirement, as they arise.

Note that this court order has no effect on the District’s beneficial ownership information requirement. The District’s law is separate and beneficial ownership information will continue to be collected in the course of regular filings.

As of January 1st, 2024 there is a new federal requirement that requires many types of entities to report who ultimately owns and controls them (i.e. beneficial ownership) to the Department of Treasury’s Financial Crimes Enforcement Network (FinCEN). A helpful introduction to the new requirement can be found here. All entities, including non-profits, should consult FinCEN’s website to understand their obligations in reporting beneficial ownership information to the federal government via FinCEN.

Helpful resources on the FinCEN site include:

Is the FinCEN Beneficial Ownership Information Report different from DC’s Beneficial Ownership reporting requirement?

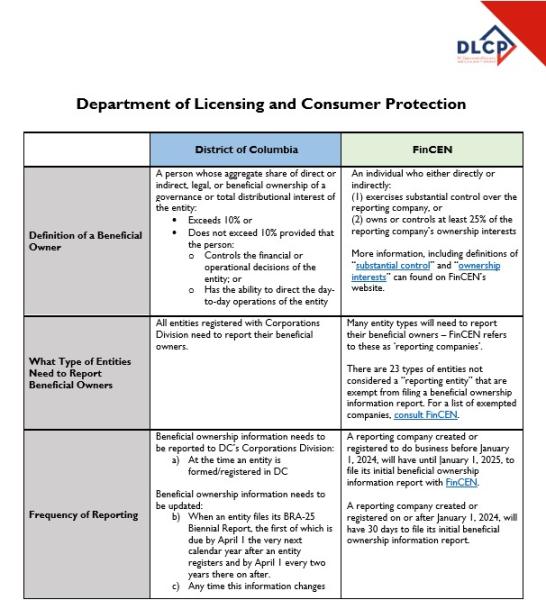

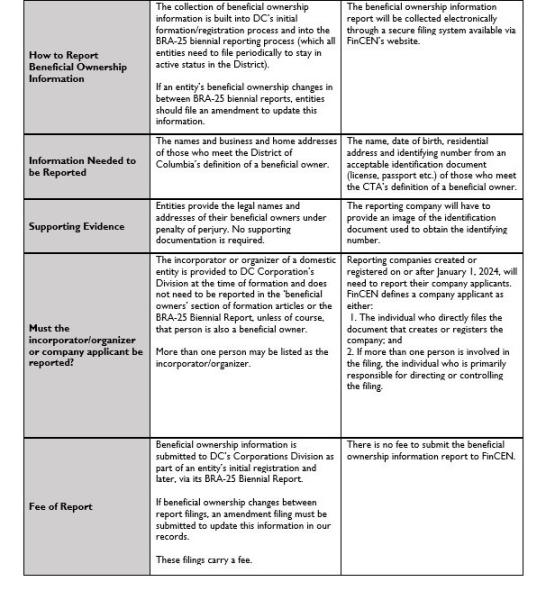

Yes. The beneficial ownership information report required by FinCEN is separate from the beneficial ownership information that is reported to the District of Columbia’s (the “District”) Corporations Division.

Since January 1, 2020, the District has required beneficial ownership information from all entities who are formed or registered to do business in the District. Now, many of these entities will also need to report beneficial ownership information directly to FinCEN.

While there are similarities between DC’s beneficial ownership requirements and FinCEN’s, they differ in a few ways. The below table summarizes some of the differences.

For more information on how this new federal beneficial ownership reporting requirement differs from the District’s, please consult our Frequently Asked Questions.

For questions regarding beneficial ownership information reporting requirements, please contact FinCEN.